Charles P. Ewing, a forensic psychologist and law professor at the State University of New York in Buffalo, said the fires were sure to catch the attention of people inclined to arson.Hmm. Yeah. Adults. Complex. Oh, right, the New York Times is still pretending that the housing bubble was something they were totally justified in ignoring. But, sexual pleasure? Is it just possible that for every two homeowners who burned down their investment property to get their rocks off, one did it to pay off his mortgage with his insurance?

They are likely the ones following the fires very closely, Mr. Ewing said. Then, it’s not uncommon for arsonists to engage in copycat activity or to piggyback on a naturally occurring fire.

Arson experts said juveniles, who are believed to be behind about half of intentional fires, are often curious about fire but do not intend to cause cataclysmic harm. Adults’ motivations are more complex.

Sometimes, Mr. Ewing said, arsonists actually derive sexual pleasure from committing the act, while others are seeking attention and may participate in extinguishing the very fires they light.

Friday, October 26, 2007

The New York Times wonders why Californians burn their houses down.

Thursday, October 25, 2007

In Manhattan Specifically

Cool housing price change tool in WSJ

Real Estate Operations

I guess it makes sense that if you were making money managing other people's property, you'd eventually start buying it. But, I'm looking for a pure play. Ideas?

Wednesday, October 24, 2007

OK, I'm now in BWX

Snap Crackle Pop

Snap, hey those traps abound!

The military broken, too much ground to pound

Torture flap, no time to nap

all o'er the map, raise the age cap

Snap is going to bring us down

The ice floes crackle and bears are drowned

Katrina left New Orleans in a dirty mound

Caps fickle, Papers trickle, UN stickle, Coal pickle

Crackle is going to bring us down

For the housing bubble, Pop's the sound

That lets us know we're economically unsound

Loose lending chop, housing starts stop, the dollar flops, we all push mops

Pop is going to bring us down

(now sing all the verses at once. You can't do it alone.)

Sunday, October 21, 2007

I wrote a song

No two are quite the same

each doing things their own way

each plays a different game

but most agree on one thing

well, all agree, let's say

That America must get out of Iraq

And George Bush is to blame

Oh, yes, American must get out of Iraq

And George Bush is to blame

He lied us in to a war of choice

And ruined our good name

Whether for oil or votes or to feather the nests

of his friends it's all the same

America must get out of Iraq

And George Bush is to blame!

Urban Astronomers

"Orionid meteors are normally dim and not well seen from urban locations," said meteor expert Robert Lunsford, adding, ". . . it is highly suggested that you find a safe rural location to see the best Orionid activity."A safe rural location. "I don't like leaving the city any more than you, but if you want to see meteors, you have to take some risks. Watch out for goats -- they can be ornery."

Friday, October 19, 2007

New Interruptor Sweeping the Nation

Tuesday, October 16, 2007

SPDR Lehman International Treasury Bond ETF

In case you missed it? We had an unnamed tropical cyclone

* -- this in response to criticism that I seemed to be rooting for the hurricanes.

Census in trouble

Let’s be clear. This is not a hearing about a potential problem or a threat but real, actual damage to the 2010 Census. The ability of the career professionals at the Census Bureau to carry out the Census and provide the country with the most accurate numbers has already been adversely affected. Without an immediate exception to get funding to the census, the accuracy of the 2010 Census will suffer even more dramatically.

Monday, October 15, 2007

Did Visa eliminate its PR department?

Visa, currently in a quiet period following a global restructuring, would not comment on the issues....A quiet period following a global restructuring? Like the reorg left them all talked out? Maybe they've taken a page from the administration and realized that not providing information is easier than spinning it.

Annals of wacky allopathy: Polio Vaccine causes Polio

And aid workers wonder why people don't trust them. The former lieutenant governor of Viriginia mentioned in the story (he reputedly got polio after his elder son Jack got the Sabin vaccine) is Jenna Bush's prospective father-in-law, by the way; that he wasn't mentioned by name does suggest the New York Times has rather a grudge against the President.In 2000, the United States switched to injected vaccine made from killed virus, which cannot mutate. But oral drops with the live, weakened version of the virus are still used in most poor countries, including those where the disease has never been eliminated: Nigeria, India, Pakistan and Afghanistan.

This vaccine, invented by Albert Sabin, is easier to give, offers much stronger protection and can beneficially “infect” other family members or neighbors, protecting them too.

But in rare cases, it can mutate into something resembling wild polio virus, which can paralyze or kill.

New York Times today

I'm not super-clear about the focus on sub-prime. Isn't it the interest-only loans that create the huge default rate? Maybe they were securitized together, but the problem wasn't pricing risk properly, it was tricking poor people into taking on the poor investment decisions of wealthier people. Maybe interest-only loans were largely subprime -- and liar loans, which are also a problem, definitely were -- but I fear that if we start talking about the housing bubble collapse as coming from a problem in the subprime markets, the solution will be to stop extending credit to the poor, which will reinforce economic stratification.

Also in the Times today, another Krugman cultural reference, now to an FDR quote (from his second inaugural address,) which I wanted to capture as I thought it was cool: “We have always known that heedless self-interest was bad morals. We know now that it is bad economics.”

Friday, October 12, 2007

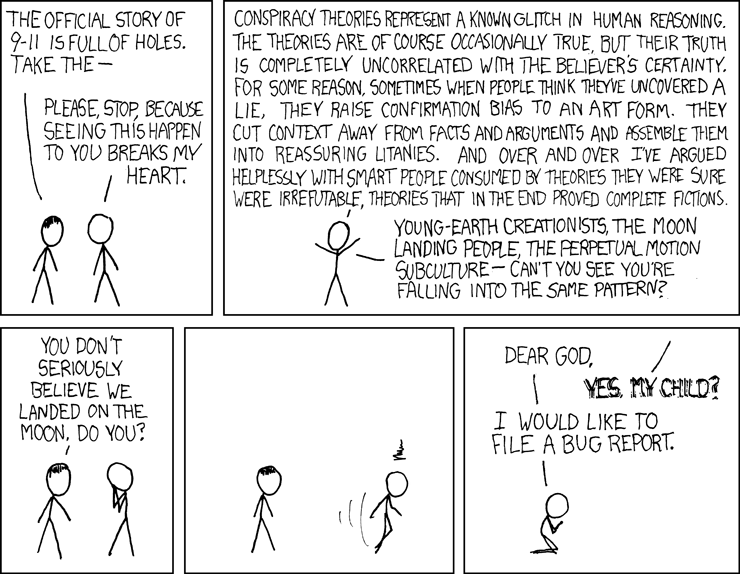

Conspiracy Theory XKCD

It's looking very much like we'll have an unnamed tropical cyclone

Thursday, October 11, 2007

Wednesday, October 10, 2007

Helping to identify losers

This is all well and good. However! They also give you a jacket. I'm mystified by this.

"Hey, nice jacket!"

"Yes, I applied for the London Marathon and didn't get in."

"I've always wanted to be rejected from that! Oh, how I envy you!"

Tuesday, October 09, 2007

Advantage: Huckabee

* -- You know, I'm the President's alter ego. Hey! I've been described as the President's alter ego!

Monday, October 08, 2007

Another investment tip

Banks are also taking over a lot of homes that they don't feel they can afford to sell. Banks traditionally get houses off their balance sheets pretty quickly, but I think the losses will be too shocking to accept. My expectation is that banks are going to end up holding on to a lot of residential real property.

But, really? Empty homes are a problem. Hobos move in, pipes burst, nobody notices leaks and displaced windows. Everything inside was designed to persist at temperatures and humidities comfortable to humans, whereas it'll be experience conditions ripe for black mold. You can't leave a house unoccupied until inflation recovers the value you bought it at and expect it to be OK.

I expect builders and banks both to start reaching out to management companies to rent all of these condos and houses that are starting to sit around. I don't know if there even are any national players, but that seems like a business that's going to seriously take off.

Talking Heads reference in Paul Krugman's column today

Just thought that was cool. Hey, it's my blog. He also writesNow, as they survey the wreckage of their cause, conservatives may ask themselves: “Well, how did we get here?” They may tell themselves: “This is not my beautiful Right.” They may ask themselves: “My God, what have we done?”

But their movement is the same as it ever was.

People claim to be shocked at the Bush administration’s attempts to equate dissent with treason. But Goldwater ... staunchly supported Joseph McCarthy.This sounds like an attack on Bush apologists' hypocrisy as they attempt to reform. But, I think actual Bushies might assert that McCarthy wasn't a bad dude. It's not just Ann Coulter -- the poison's everywhere.

Um ....

[Charles Schulz' son Monte] said his mother, Joyce Doty, was very upset at being portrayed [in the Peanuts creator's biography] as an overbearing and shrewish. Reached at her home in Hawaii, she said, “I am not talking to anybody about anything.”

Sunday, October 07, 2007

Just going through some old email

OK, what's my goal? I want to be sure that you're evaluating your risk correctly. Now, if I pay $18,000 per year in rent, I'm gambling that a real investment would lose at least that. I could afford maybe a $300K house on a 15-year mortgage, so I'm gambling on a 6 % / year decline. But, I think it'll be much faster.So ... I think that's still more or less correct, although then I was predicting the inevitable and now we're living it. I may have had some effects out of order -- my email doesn't mention the five-year balloon payments, because I'd only started blogging on June 2nd, and didn't fully grok that people never follow links; they're what the referenced article is about.

The real estate market is local. However, the mortgage rates are national, the investment capital seeking shelter is national, and the repeatedly disproven investment meme 'safe as houses' is national. Furthermore, the drop in the value of the dollar making real investments attractive to foreigners is national, and the top 6 home builders provide some large share of the market. Moreover, there's a global housing bubble driven by some of these (obviously not the last two) same effects.

Here's another article.

http://www.businessweek.com/bwdaily/dnflash/jun2005 /nf20050616_5078_db016.htm

The point of which is that between the subprime lending, the investors* and the people who are making their minimum payment (60% of WaMu borrowers who borrowed last year) there are going to be a lot of defaults even if interest rates don't rise, which is inconceivable. Defaults bring housing prices down, which eliminates equity lines of credit, eviscerating consumer spending, reducing business activity and making a whole new slew of people unable to make their monthly payments. When they do rise, the profit takers Fortune speaks of will act, selling in a flurry and bringing prices down. In the third wave, the equity lines of credit will already be gone, but the house price drop will be much faster, shutting down housing starts and leaving us with a gross overinventory of houses, which accounting rules will force on the market, dropping the prices a fourth time. So, that's my thesis. A four-stage drop, with an attendant depression and a massive surge in homelessness. I'm gloomy!

You either have to time the market -- I'd expect mortgage origination to peak when rates start to edge up, but that's when all of the other profit-takers will act -- or hold on to your apartment until it has lost only as much value as you would have paid in rent + excess taxes. Or, you know, lose money.

RFM

* --- this article does not speak of investors, but you know they're out there: more this year than last, twice as many last year as three years before. I believe 16.8% of new mortgage originators are declared investors, and [a mutual friend who had told us she was misrepresenting an investment purchase as a primary residence] explained the rationale not to declare.

My argument leaves out the home builders' carrying costs and intent to sell, which helps clarify the market in a lot of places. Also, it seems to imply I understood the global housing bubble better then than I do now, which is certainly possible. And we haven't really gotten into the economic contraction-housing deflation cycle. But, while we feel like we have a lot of empty houses, they're to a large part new construction -- I don't imagine that the default rate has really hit its stride -- it's only, what, three times what it was two years ago?

update: In the interest of humility, I did want to point out an error. Home equity lines of credit dried up all at once. They're already gone. It's not going to get worse in depreciation-contraction cycles.

Thursday, October 04, 2007

Don't Be Fool! Don't Buy Now! Let Them Pop!

Here's a video to support my assertion that there's a collapsing housing bubble in the same countries that are complaining about higher grain prices.

Wednesday, October 03, 2007

Blackwater Comparative Costs

I haven't seen mentioned in these discussions that, since Blackwater hires exclusively ex-military, we have already paid to train them, and they typically left before they qualified for their pension. We can drop those costs from the analysis.

Tuesday, October 02, 2007

Monday, October 01, 2007

Carol Anne Gotbaum apparently strangled herself

It's nice when the wealthy and powerful fall into the traps lain for the indigent and disempowered, as it's the only way the rules can get changed. They're the stories we hear about. I'm not saying you can't accidentally strangle yourself when handcuffed, but the fact that Mrs. Gotbaum was left unsupervised long enough for it to happen points to a problem with hiring minimum wage workers and leaving the mechanisms of the state in their hands.Carol Anne Gotbaum, 45, was arrested Friday at Sky Harbor International Airport in Phoenix after she allegedly became “irate” when gate crews refused to let her board a flight for which she was late, according to US airways officials. She died at the airport.

Gotbaum, 45, of the upper West Side of New York, died less than an hour later, after cops claim she apparently strangled herself while trying to escape from the handcuffs in a holding cell at Phoenix Sky Harbor International Airport.

Her step-mother in law may run for mayor, and I think the more people who've suffered due to this sort of thing that we have in positions of authority, the better off we are. So, until I find out she actually has unsupportable views, I'm going Betsy Gotbaum 2009!